QuickFundr | Loan Providing App

-

Understanding Client Requirements:

The project involved developing an online platform for a financial institution specializing in personal and business loans. Initial consultations with the client aimed to grasp their specific needs, objectives, and target market. Key considerations included creating a secure and user-friendly interface, facilitating easy loan applications, and ensuring efficient processing.

-

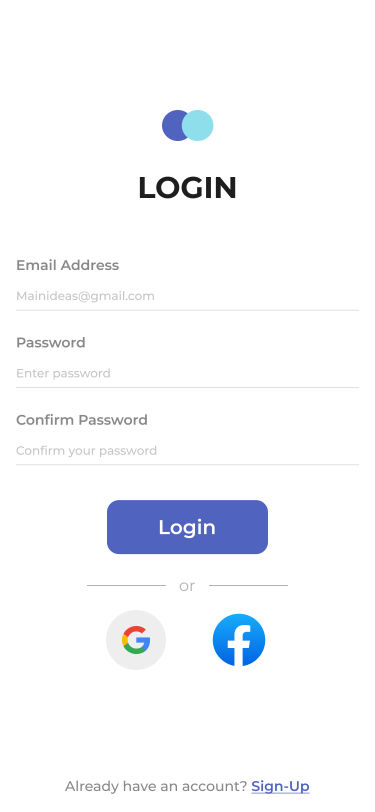

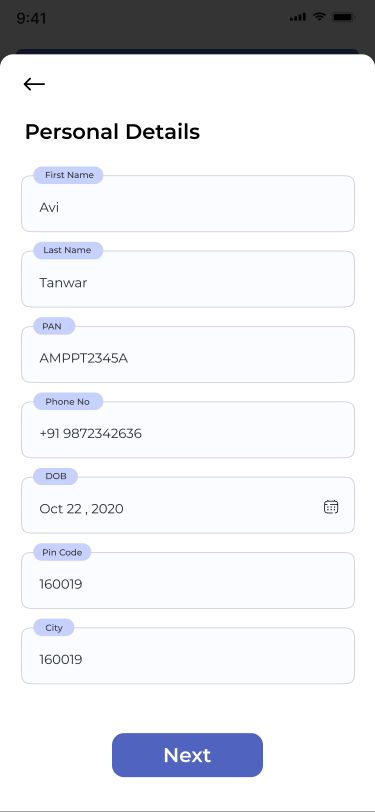

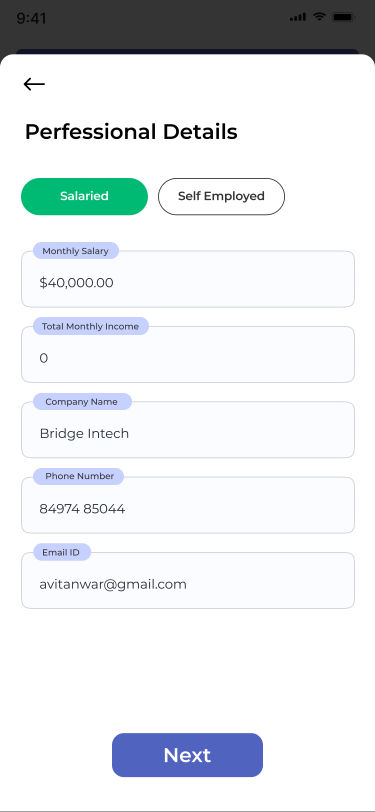

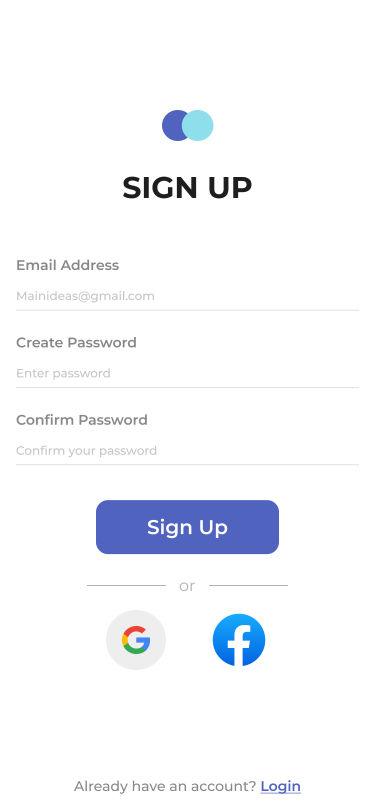

App Design and User Interface:

To meet the client's objectives, the app was designed with a focus on simplicity, security, and accessibility. The user interface (UI) was crafted to be intuitive, guiding users seamlessly through the loan application process. Clear navigation and minimalist design elements were prioritized to enhance user experience.

-

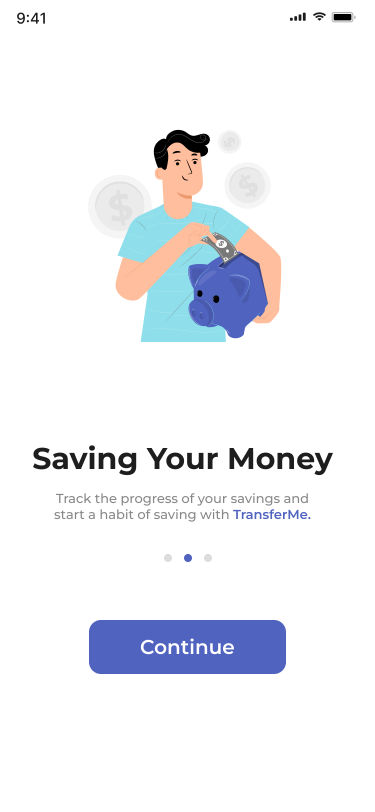

Loan Products Showcase and Descriptions:

The app prominently displayed the range of loan products offered by the client. Each loan option was presented with detailed descriptions, eligibility criteria, and terms. The goal was to provide users with comprehensive information to help them make informed decisions about their borrowing needs.

-

Loan Calculator Tool:

A key feature of the app was the integration of a loan calculator tool. Users could input their desired loan amount, preferred repayment period, and interest rate to estimate their monthly repayments. The tool provided instant results, empowering users to plan their finances effectively and understand the cost implications of borrowing.

-

Document Upload and Verification:

To streamline the loan application process, the app allowed users to upload required documents directly from their devices. The uploaded documents were securely stored and processed for verification by client's team. This feature minimized paperwork and accelerated the application review process, leading to faster loan approvals.

-

Customer Reviews and Testimonials:

To build trust and credibility, the app featured customer reviews and testimonials. Users could access feedback from past borrowers regarding their experiences with XYZ Loans' services. These testimonials were strategically placed to instill confidence in potential borrowers and showcase the institution's reliability.

-

Secure Payment Gateway Integration:

The app incorporated a secure payment gateway for loan repayments. Users could make payments conveniently using various methods such as credit/debit cards, bank transfers, or digital wallets. Stringent security measures were implemented to safeguard users' financial information and ensure transactional integrity.

-

Mobile Responsiveness and Cross-Platform Compatibility:

Recognizing the prevalence of mobile usage, the app was developed to be fully responsive and compatible across different devices and operating systems. Whether accessed from smartphones, tablets, or desktops, users could enjoy a consistent and optimized experience. This ensured accessibility and convenience for users on the go.

-

Compliance with Regulatory Standards:

Compliance with financial regulations and data protection laws was a top priority during app development. The app adhered to industry standards and regulations such as GDPR (General Data Protection Regulation) and PCI DSS (Payment Card Industry Data Security Standard). Robust encryption protocols and data handling procedures were implemented to safeguard user privacy and confidentiality.

-

Conclusion:

The development of QuickFundr required meticulous planning, collaboration, and attention to detail. By understanding the client's requirements and target audience, the development team successfully delivered a secure, user-friendly, and feature-rich platform for loan applications. The integration of loan product showcases, calculator tool, document upload facility, and secure payment gateway contributed to an enhanced user experience. The app serves as an effective tool for our client to expand its reach, streamline loan processing, and provide financial solutions to its customers.

Project Screenshots

Project Glossary

Information

Date - Feb 07, 2024

Tags -

Consult us for free?

View More